Shipping policy

Last updated: July 6, 2023

At cronus.shop, we're dedicated to delivering your purchase as quickly and affordably as possible. The shipping times shown at the checkout are estimates, so it's a good idea to factor in an extra day or two. All returns and other mail should be sent to Cronus, 6232 Spotswood Trail, Penn Laird, VA, 22846 USA.

USA SHIPPING

-

Free USA Economy Shipping: Enjoy complimentary economy shipping for all USA orders over $150 through USPS Ground Advantage. Check estimated delivery times during checkout. Please note: a parcel must have no tracking movement for 30 days before we can issue a replacement or refund.

-

USPS & UPS Shipping: For USA orders under $150, we provide shipping via USPS Ground Advantage & UPS Ground. Check estimated delivery times during checkout. Please note: a parcel must have no tracking movement for 30 days before we can issue a replacement or refund.

-

UPS Expedited Shipping: If you're in a hurry, we have UPS Expedited and UPS Next Dair Air Priority and USPS Express Shipping available at discounted rates. Prices and delivery estimates are available during checkout.

-

Same-Day Dispatch: Ensure your order is in before 5 PM from Monday to Friday, and we'll typically dispatch it the same day. For orders after 5 PM on Fridays, expect dispatch by the next Monday. If there's an opportunity for a Saturday shipment, we'll do our utmost to get it out to you.

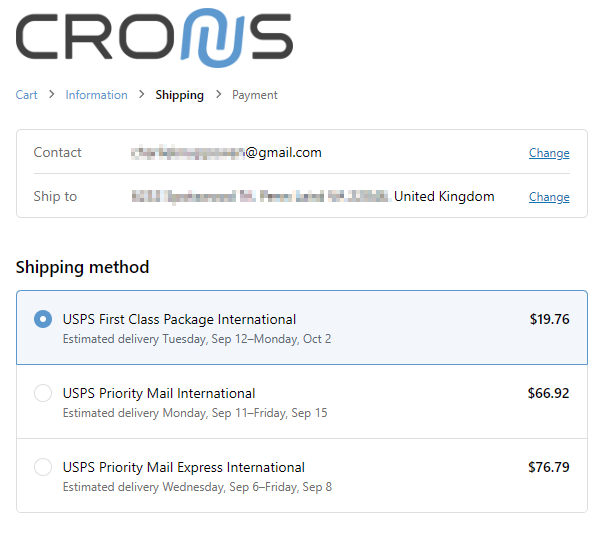

INTERNATIONAL SHIPPING

-

USPS, UPS, & DHL Worldwide Delivery: We take pride in serving our international customers, offering competitive shipping rates for over 180 countries.

-

Customs and Import Fees: Please be aware that when your order arrives at its destination, you may be subject to additional customs or import duties, as determined by your country's policies. These fees are not included in our pricing. Certain areas also enforce a Value Added Tax (VAT)—for example, 20% in the UK or 25% in Sweden. It is important to note that these additional charges are the responsibility of the buyer.

Important Note:

In the event that the applicable taxes are not paid, please be aware that you will be responsible for all associated shipping costs in both directions, in addition to a $35 "refused delivery" charge. This policy is in place to manage the implications of non-compliance with tax payments and to cover the logistical costs incurred. -

Possible Delays in U.S. Customs: Occasionally, international parcels have a brief stay in U.S. customs before joining your local postal service. If your tracking shows no movement for a few days, it's all good! Your package is simply preparing for its onward journey to your doorstep.

-

Order Processing Time: Submit your order by 5 PM EST (Eastern Standard Time) between Monday and Friday, and we usually dispatch it the same day. Any orders after 5 PM on Fridays? They're earmarked for Monday. If there's a chance to dispatch on a Saturday, trust us to grab it. For our friends in the UK, our 5 PM EST cutoff is equivalent to your 10 PM (+5 GMT).

-

We strongly advise reviewing these terms closely and that you prepare for any additional payments that may be required upon the delivery of your order. Understanding and adhering to these guidelines will ensure a smooth and hassle-free receipt of your items.

TRACKING YOUR ORDER

Upon shipping your order, we'll provide tracking details through email or SMS, allowing you to monitor its journey and expected arrival. Temporary pauses in tracking updates can occur due to occasional USPS staff shortages.

For a comprehensive view of your order status and more, simply log in at account.cronus.shop.

![]()

Should you have any questions or need further clarification on shipping, customs, import fees, or any other aspect of your order, please do not hesitate to reach out to our customer support team. We are here to assist you every step of the way and ensure your satisfaction with your purchase.

Thank you for shopping with us and trusting us with your purchase. We're committed to making your shopping experience the best it can be.

If you have any questions or concerns, feel free to reach out to our customer support team at cronus.support.